FAX Flagship Fund

Investment Philosophy

Fund Highlights

High-quality North American SME

Public target size < $10B

Private target size < $1B

Public and private cross-over

Concentrated portfolio

Disciplined and proven process

Constructive Active Ownership

Long-term approach

Fund Objective

Focus

Small cap public & private companies

Significant minority and/or control positions

Capital structure agnostic

Approach

Disciplined

Long-term

Active

Concentrated

Structure

Permanent capital to maximize compounding

Efficient operating structure

Internally managed i.e. no management fees

Team

Aligned with shareholders

Proven operators

Long-term track record

Business Charateristics

Economic resilience

Ability to protect and develop its market

Competitve differentiation

Established brands

Reinvestment opportunities

Management Charateristics

Capable and honest management

Demonstrable track record

Disciplined capital allocation

Alignment

Financial Charateristics

Recurring revenue

Durable earnings growth

Balance sheet flexibility

High returns on capital

Portfolio Company Characteristics

Business Characteristics

Economic resilience

Ability to protect and develop its market

Competitive differentiation

Established brands

Reinvestment opportunities

Management Characteristics

Capable and honest management

Demonstrable track record

Disciplined capital allocation

Alignment

Financial Characteristics

Recurring revenue

Durable earnings growth

Balance sheet flexibility

High returns on capital

The Fund Advantage

Disciplined approach to quality

SME focus

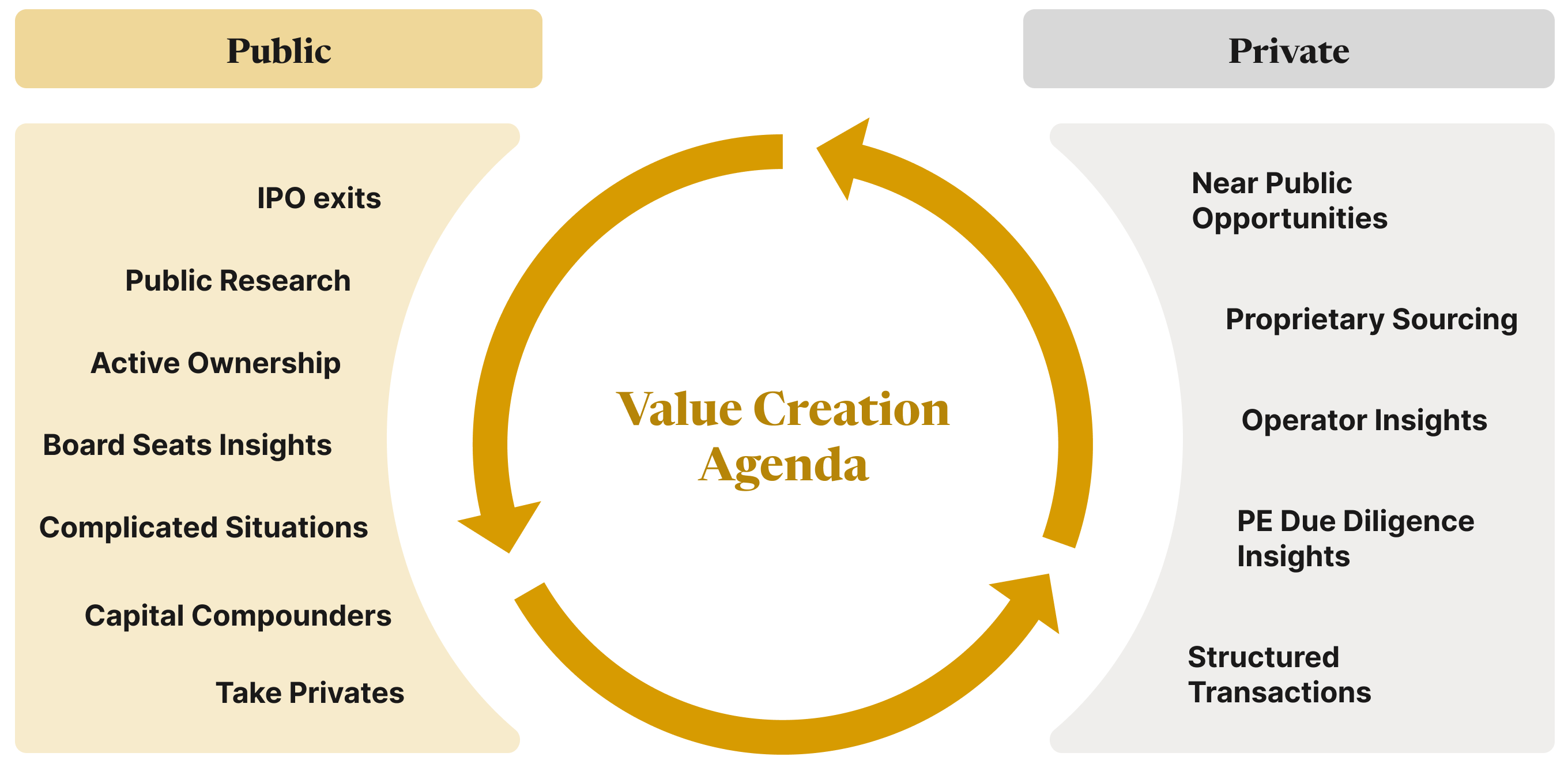

Crossover strategy

Strong investment team and process

Active approach

Relative lack of competition

Long-term orientation

Operational background and track record scaling businesses